Global payments revenue is projected to rise to 2.4 trillion US dollars by 2029, according to the Boston Consulting Group’s (BCG) latest research. However, growth is expected to moderate to 4 percent annually over the next five years, reflecting a shift in the industry as agentic artificial intelligence (AI), digital currencies, and fintech-led disruption reshape the global payments landscape.

The findings are contained in BCG’s 23rd annual Global Payments Report, titled The Future Is (Anything but) Stable, released on Tuesday. The study draws on BCG’s Global Payments Model, covering more than 60 economies that account for over 90 percent of global GDP, including South Africa, Kenya, Nigeria, Morocco, and Egypt.

Inderpreet Batra, BCG managing director and global head of payments and fintech, described the sector as entering a new phase. “Traditional growth levers are losing force, but new drivers including agentic systems, programmable money, and fintech innovation are rapidly coming into focus. The players that align to these shifts now will lead the next decade,” he said.

Africa emerges as a payments growth engine

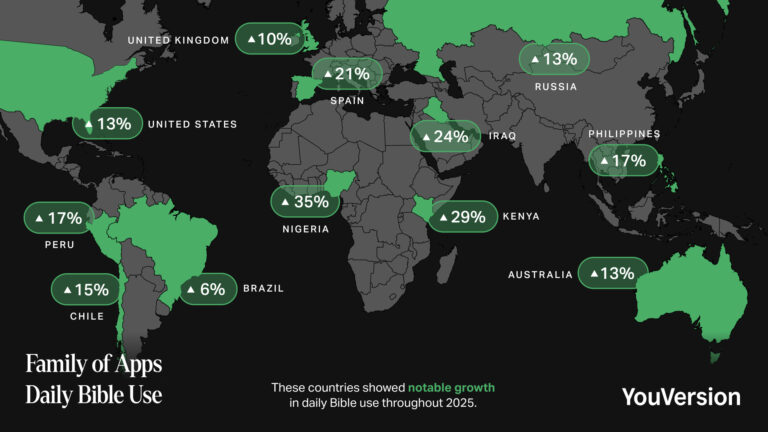

Global payments revenue reached 1.9 trillion US dollars in 2024, with growth having averaged 8.8 percent annually since 2019. Looking ahead, expansion is expected to slow to 4 percent annually, yet Africa remains an outlier. The continent’s payments revenue is forecast to nearly double, growing from 9 billion US dollars in 2024 to 19 billion US dollars by 2029, a compound annual growth rate (CAGR) of about 10 percent.

Kenya is expected to mirror this momentum. The country’s payments revenues are forecast to expand from 0.5 billion US dollars in 2024 to 0.8 billion US dollars in 2029, representing an 8 percent CAGR. The growth will be driven mainly by transaction revenues supported by the widespread use of mobile money and emerging real-time payment solutions.

“As Africa’s payments sector accelerates towards 19 billion US dollars in revenues by 2029, Kenya is keeping pace with the continent’s digital transformation,” said Takeshi Oikawa, BCG Managing Director and Partner in Nairobi. “Kenya’s experience demonstrates the power of fintech and mobile innovation to drive Africa’s journey toward becoming a global payments growth leader.”

New forces shaping global payments

The report highlights five structural shifts defining the future of payments: the rise of agentic AI, digital currencies such as stablecoins, fintech disruption, real-time account-to-account (A2A) systems, and the continued push for cost transformation.

- Agentic AI is projected to influence over 1 trillion US dollars in e-commerce spending, with 81 percent of US consumers expecting to use AI-driven tools for shopping.

- Stablecoin volumes reached 26 trillion US dollars in 2024, although real-world payments make up just 1 percent of that total.

- Payments fintechs generated 176 billion US dollars in revenue in 2024, growing at 23 percent annually, and now account for 45 percent of total fintech revenue.

- Real-time A2A payments rose by 40 percent globally in 2024, accounting for a quarter of digital retail payments worldwide and over half in markets such as India and Brazil. In Africa and the Middle East, adoption is projected to exceed 50 percent by 2030.

Markus Ampenberger, BCG managing director and partner, said the winners of the next era in payments will be those that embed innovation into their operations and customer propositions. “The next winners in payments will not just be fast adopters of technology. They will be the firms that deeply integrate new capabilities into business and operating models,” he said.